straight life policy cash value

In this case the death benefit increases as the cash value does. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

Limited Pay Whole Life Insurance With Sample Rates For 10 20 Pay

His insurance agent told him the policy would be paid up if he reached age 100.

. It usually develops cash value by the end. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. The 20000 that remains will be collected by the insurance company.

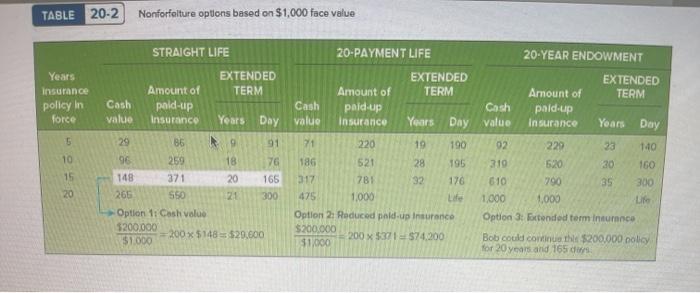

Also known as whole life insurance a straight life policy has a cash. Straight whole life insurance require more premium than term life insurance policies for the same death benefit in the early years of a policy and less premium than term life insurance in later. Convert the cash value to a paid-up term policy.

A straight life insurance policy provides lifelong coverage at a consistent premium rate. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. It also gives policyholders the ability to take advantage of outside investment opportunities through policy loans.

Which of the following could be a future use of cash value that builds in a recently-purchased whole life insurance policy. A straight life insurance policy can also build cash value over time. Its been used for centuries to grow and protect policyholders moneyand not just by the wealthy.

The cash value of a straight life policy grows like one. The cash value grows slowly tax-deferred meaning you wont pay taxes on. This death benefit equals the cash value plus the death benefit your policy was issued with.

The whole life provides lifelong coverage and includes an investment component known as the policys cash value. Universal life insurance is a type of. A straight life insurance policy often known as whole life insurance.

Ad Cash in your life insurance policy. A straight life insurance policy is one of the oldest types of insurance. Also known as whole life insurance a straight life policy has a cash.

Another asset of a straight life policy is a cash value account. Rob purchased a standard whole life policy with a 500000 death benefit when he was age 30. Variable life insurance is a type of permanent life insurance with a cash value and with investment options that work like a mutual fund.

What is Straight Life Insurance. Also known as whole life insurance a straight life policy has a cash value account that grows in size as you contribute premiums.

Cash Value Life Insurance What You Need To Know The Insurance Pro Blog

Is A Straight Life Insurance Policy Right For You Wealth Nation

Is A Straight Life Insurance Policy Right For You Wealth Nation

Annuity Payout Options Immediate Vs Deferred Annuities

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Cash Value Life Insurance Is It Worth It Financial Samurai

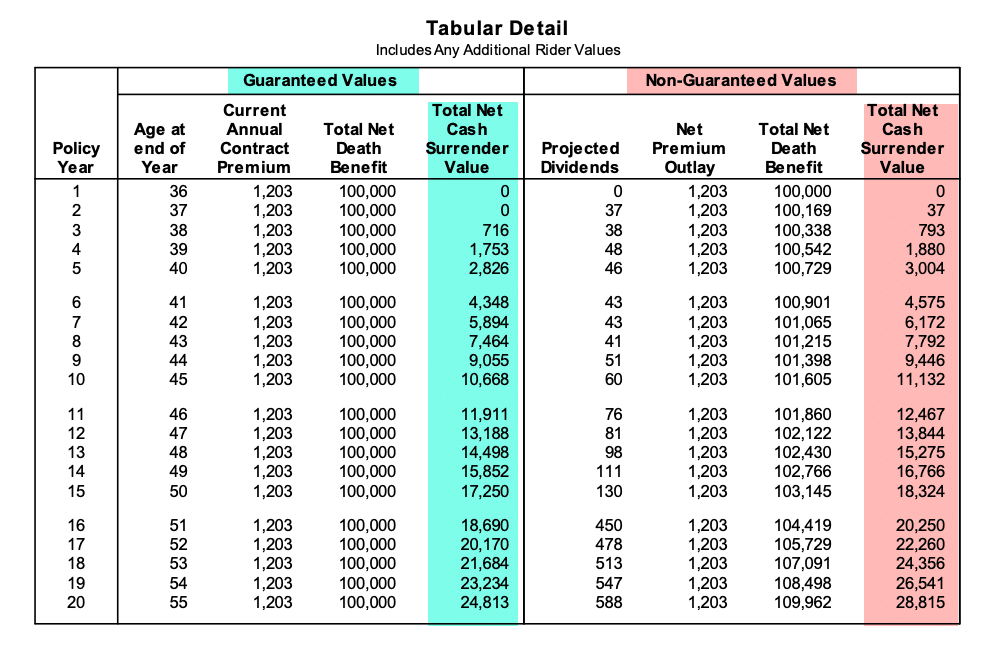

Solved Calculate The Cash Surrender Value For Lee Chin Age Chegg Com

Synonyms For Whole Life Insurance Thesaurus Net

Life Insurance Withrow Insurance Services

What Is Term Life Insurance Ramsey

Limited Pay Life Insurance Everything You Need To Know

What Are The Principal Types Of Life Insurance Iii

Life Insurance Purposes And Basic Policies Mu Extension

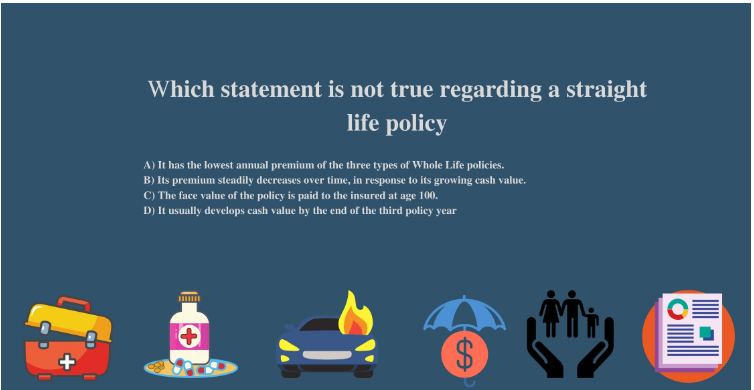

Which Statement Is Not True Regarding A Straight Life Gudwriter

Straight Life Insurance New York Life

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)